To arrange savings through m-zaba, you need to verify your email address because we will use it to send the arrangement documents. If you do not enter and/or verify an email address, don't worry - you can verify it in m-zaba settings.

m-zaba savings

You no longer need to visit the bank for savings! Arranging savings is simple, fast and safe, now using online banking and our mobile app (m-zaba)!

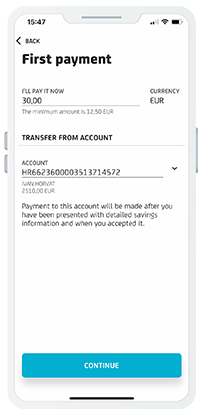

Single or multiple payments

You can save by making a single term deposit, or by making multiple payments during the entire term deposit period.

You can increase your savings by additional payments at any time and in the amount which suits you, regardless of the working hours of our branches.

Currencies

You can arrange savings in EUR, USD, AUD, CAD or GBP.

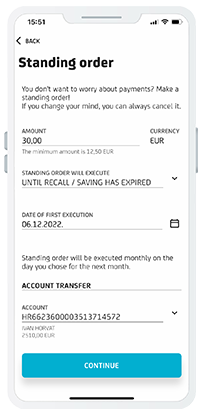

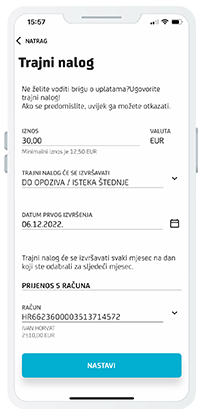

Set up a standing order

If you want to make regular payments for savings, you can set up a standing order, so the Bank can directly transfer funds from your account to your savings.

Flexibility

Simply adjust your savings to the new circumstances.

Change the target savings amount or close your savings account as required.

m-zaba savings is available as an online banking function in our mobile app (m-zaba).

How to get m-zaba?

Installation

Download the application via the Google Play, the App Store or the App Gallery:

Activation

After you download the app, you need to activate it by entering the identification and activation keys. After that, you need to choose a PIN for the future use of m-banking and m-token.

Savings through m-zaba can be arranged over a minimum period of 18 months and the maximum period is 60 months in EUR, AUD, CAD and GDP. After the term deposit ends, the interest is added to the principal and the new amount is renewed automatically. You don't need to visit a branch. Savings is renewed for the same period with a valid interest rate.

If you arrange Open Savings through m-zaba, you do not need to set up a standing order. Savings can be made through multiple payments during the term deposit period, as frequently as you wish. If you change your mind, you can always set it up later.

You can arrange multiple savings accounts at once. Information on savings can be monitored in your m-zaba.

You can access the Open Savings arrangement process by selecting Products at the bottom of the app screen.

In your m-zaba, you can change the name, category or savings target amount at any time. You can do so by clicking on the modify icon, located in the upper right corner of the savings you wish to modify.

Yes, you can. You can do so in the content section of the standing order you wish to cancel.

Yes, you can. You can do so in the content section of the savings you wish to close.

The funds can be used any time. If you make an early withdrawal of fixed-term deposits, the payment is made to your account, and a vista interest rate is accrued on the deposit.